Thesaur - The World's First Phygital Commodity

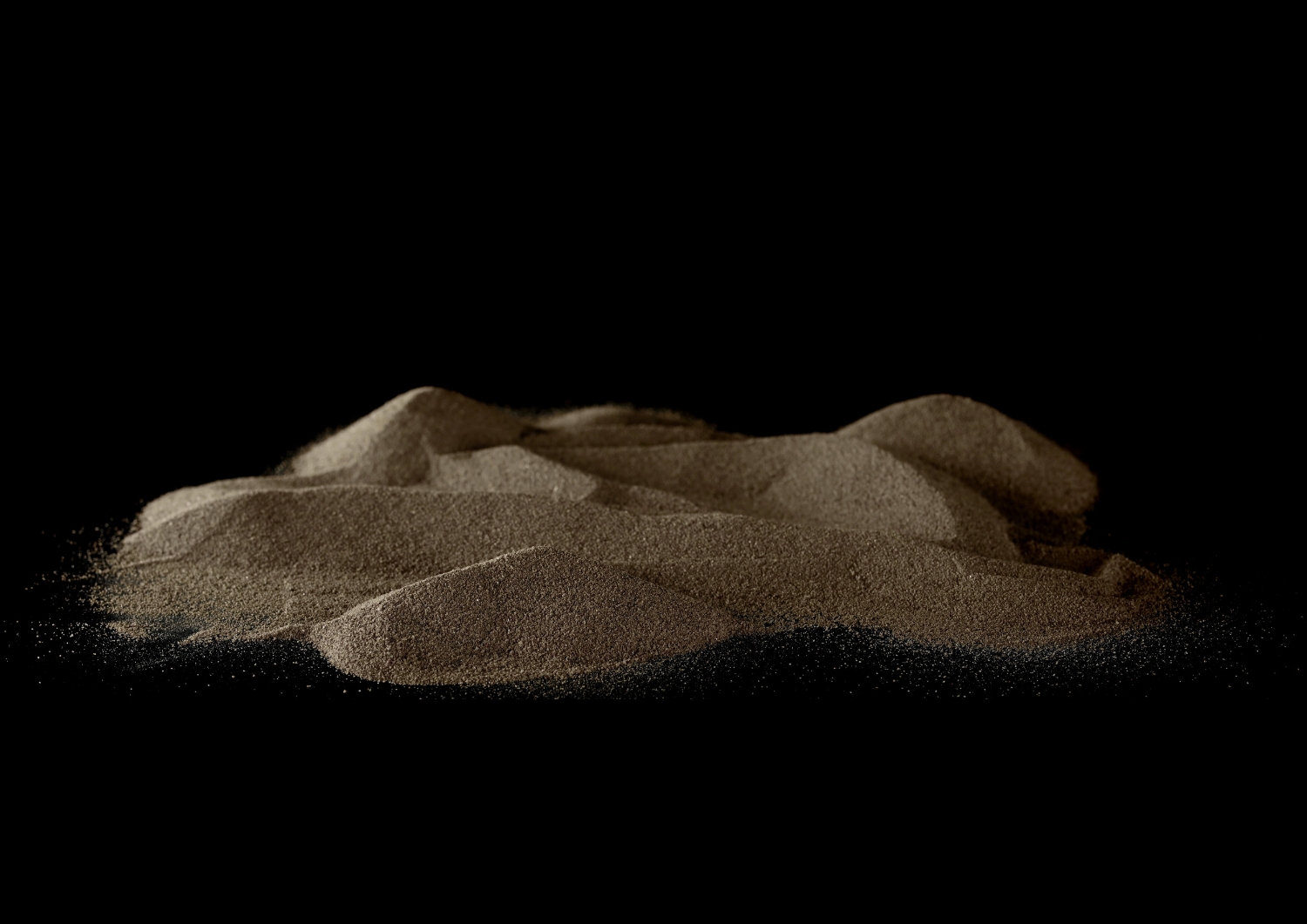

The fusion of tangible industrial value creation and its secure digital representation, unlocking transparency, traceability and global access.

The Strategic Imperative for a Secure Supply

Critical European industries face severe geopolitical and regulatory vulnerabilities by relying on High-Purity Quartz Sand (HPQS) from unstable regions. Thesaur provides a vital, EU-domestic source to ensure strategic autonomy and de-risk supply chains.

HPQS is scarce, and over 70% of its processing occurs in Taiwan. Furthermore, much of the polysilicon industry relies on materials from China's Xinjiang region, creating regulatory and human rights risks for European companies.

An EU-domestic source of HPQS is a long-term strategic asset. It reduces exposure to supply chain disruptions, geopolitical instability, and restrictive trade policies, ensuring European industries can operate without interruption.

Our location is positioned to serve the proposed €5B Black Sea AI Gigafactory, a key part of the EuroHPC AI Factory Initiative. This positions Thesaur at the heart of Europe's push for technological sovereignty.

Strategic Market Analysis

The silicon wafer market is not just growing; it's being fundamentally reshaped by powerful technological trends and high-stakes geopolitics. Understanding these drivers is key to recognizing the strategic value of Thesaur.

Key Technology Trends & Demand Drivers

The insatiable demand for advanced chips for AI infrastructure, combined with the 5G rollout and IoT proliferation, creates compounding demand for logic, memory, and sensors.

The 300mm (12-inch) wafer is the backbone of all modern, advanced-node semiconductor manufacturing, commanding 63.1% of the market and offering superior economies of scale.

200mm (8-inch) fabs are a critical, capacity-constrained ecosystem for specialty technologies like MEMS, RF chips, and power semiconductors essential for automotive and IoT.

The push towards 2nm nodes places unprecedented demands on wafer quality, where even atomic-level defects can kill yield, cementing the market power of top-tier suppliers.

The New Silicon Geopolitics: A Strategic Chokepoint

The "Chip Wars" are a battle for control over the silicon supply chain, which is fraught with chokepoints. While the West focuses on building multi-billion dollar fabs, it remains dangerously dependent on a supply chain where China dominates the primary raw material: polysilicon.

This complex geopolitical landscape makes a domestic, EU-based source of high-purity quartz like Thesaur not just a commercial opportunity, but a strategic imperative. Explore the two sides of this conflict below.

The US and EU are investing hundreds of billions to 're-shore' chip manufacturing and reduce dependence on Asia.

China is pursuing a patient, asymmetric strategy to mitigate its own vulnerabilities while aiming to control new supply chain chokepoints.

Global Silicon Wafer Market: Key Players

Shin-Etsu Chemical Co., Ltd.

Tokyo, Japan

Dominant market leader; vertically integrated; "ultra-pure" 300mm polished and epitaxial wafers.

SUMCO Corporation

Tokyo, Japan

"Pure-play" wafer manufacturer; advanced crystal growth and polishing technologies; 300mm wafers for logic and memory.

GlobalWafers Co., Ltd.

Hsinchu, Taiwan

Top-tier global supplier across all wafer sizes (200mm, 300mm); strong position in polished and epitaxial wafers.

Siltronic AG

Munich, Germany

Key European supplier; strong in 200mm and 300mm; advanced polished and epitaxial wafers for logic and memory.

SK Siltron Co., Ltd.

Gumi, South Korea

Subsidiary of SK Group; major supplier to South Korea's memory and logic fabs; strong in 300mm.

Soitec S.A.

Bernin, France

Specialized market leader; critical supplier of Silicon-on-Insulator (SOI) wafers for RF, power, and photonics.

| Company | Headquarters | Market Specialty |

|---|---|---|

| Shin-Etsu Chemical Co., Ltd. | Tokyo, Japan | Dominant market leader; vertically integrated; "ultra-pure" 300mm polished and epitaxial wafers. |

| SUMCO Corporation | Tokyo, Japan | "Pure-play" wafer manufacturer; advanced crystal growth and polishing technologies; 300mm wafers for logic and memory. |

| GlobalWafers Co., Ltd. | Hsinchu, Taiwan | Top-tier global supplier across all wafer sizes (200mm, 300mm); strong position in polished and epitaxial wafers. |

| Siltronic AG | Munich, Germany | Key European supplier; strong in 200mm and 300mm; advanced polished and epitaxial wafers for logic and memory. |

| SK Siltron Co., Ltd. | Gumi, South Korea | Subsidiary of SK Group; major supplier to South Korea's memory and logic fabs; strong in 300mm. |

| Soitec S.A. | Bernin, France | Specialized market leader; critical supplier of Silicon-on-Insulator (SOI) wafers for RF, power, and photonics. |

Key Investment Highlights

A snapshot of the core economic data that defines this high-value investment opportunity. These figures are derived from our comprehensive business plan and definitive feasibility study.

€1M / 1% Equity

570% IRR

€13.85 Billion

Asset-Referenced Token

A Tangible Asset for a Digital Age

Thesaur offers a unique opportunity to invest in a foundational physical asset, de-risked by a 50 million ton high-grade silica deposit, out of which 31.2 million tons are verified, audited reserves.

Equity Participation Option

Gain direct equity in Thesaur, with shareholder rights under EU law, governance rights, and full dividend income from industrial profits.

Usufruct (Use-of-Fruits) Option

For those seeking high yield without equity complexity, this option grants the same financial benefits (profit sharing) without holding shares, fully recognized under the Romanian Civil Code.

Asset-Backed Security & Offtake Agreements

Equity investments benefit from an Asset Guarantee, with assets pledged at the invested amount. Plus, MoUs worth over €200M annually are in place with a major European-Chinese photovoltaic manufacturer.

Profitable Worst-Case Scenario

Even raw, unprocessed silica sales would generate ~$30M annual revenue (ROI < 2 years), ensuring downside security and priority reimbursement of capital.

Governance & Future Participation Rights

Investors may appoint a Non-Executive Director, with voting rights and anti-dilution protection. Early investors also gain preferential rights to future ventures like Thesaur City.

Industrial Profit Share

Receive equity-tied dividends or usufruct benefit distributions from industrial operations, with a cumulative ROI of 971% in 5 years and 13,752% in 33 years.

Token Capital Gains

Exposure to eSand’s exponential upside potential (25x–33x from $30 to $800–$1,000) in the short term, and up to 323x modeled long-term.

Token Ecosystem Rewards

Passive annual income rewards (7.5%–15% range) from eSand token operations like value stabilization and buy-back strategies.

Strategic EU Asset

Mitigate geopolitical and regulatory supply chain risks with a domestic European source of HPQS.

Exceptional Returns

IRR of 570%, with an NPV of €3.37B (at 8.9% DR) or €1.26B (at 20% DR), highlighting massive profit potential.

Phased CapEx

Total required CapEx of ~€45M, split into a €20M Phase 1 and a €25M Phase 2 financed from cash flow.

Explore the Deposits

An animated, multi-layered visualization of our geological assets, showcasing the depth and structure of the sand, clay, and quartz deposits.

A Vertically Integrated Production Powerhouse

Our project integrates a 31.2 million-ton quartz reserve with a state-of-the-art processing plant, designed to transform raw materials into high-value products for global tech industries.

Total Reserves

31.2M Tons

Of verified, high-quality quartz sand.

Mine Lifecycle

31 Years

Based on a 1M ton per annum extraction rate.

High-Tech Production

+99% Silica

Achieving superior purity for HPQS products.

Phase 1: Mineral Products

CapEx: €20 million

Essential for glass, solar, and semiconductor industries.

Coarse and fine aggregates for concrete and mortar.

Crucial for ceramics, pottery, bricks, and tiles.

Valuable By-Products

Zircon (ZrSiO4)

For advanced ceramics and refractory materials.

Titanium Dioxide

Key white pigment for paints and cosmetics.

Calcium Carbonate

Used in construction, cement, and as fillers.

Phase 2: High-Tech Products

CapEx: €25 million (from cash flow)

Solar & Semiconductor-Grade Polysilicon

The essential raw material for ingot production, targeting >9N purity.

Monocrystalline Silicon Ingots

The foundational material for high-efficiency solar cells and modern electronics.

High-Performance Silicon Wafers

The fundamental substrate for manufacturing microchips and PV cells.

Key Mineral Products

Our strategy is built around six main core mineral groups, processed to meet the demands of various industries. Click on a product to learn more.

.cc7f3b54.jpg)

The crystalline form of silica, essential for float/container glass, PV solar panels, semiconductors, and fiberglass components.

A fine aggregate used in concrete, mortar, backfill, and surface treatments. We produce both coarse "concrete sand" and "fine sand".

A rare sedimentary material made from kaolinite. Its plasticity makes it a crucial base material for ceramics, pottery, bricks, and tiles.

Extracted through quarrying, used in construction as a building material, in cement, and for soil conditioning in agriculture.

.f01b9b6d.jpg)

A widely used white pigment known for its brightness and high refractive index. Used in paints, sunscreens, cosmetics, and even as a food coloring.

A durable mineral used in high-quality refractory materials, advanced ceramics, and for producing zirconium compounds for metallurgy and casting.

Key High-Tech Crystalline Products

From our high-purity quartz, we produce monocrystalline silicon ingots and wafers. These serve as the foundational materials for the semiconductor and photovoltaic industries.

Structure & Quality

Composed of a single, continuous crystal structure with minimal defects, essential for high-performance electronics.

Purity Levels

Ranges from solar-grade (6N, or 99.9999%) to electronic-grade (>9N, or 99.9999999%).

Production Method: Czochralski (CZ) Process

A method of growing high-quality single crystals by pulling a seed crystal from a melt. The key phases are:

Melt Preparation

High-purity silicon is melted in a quartz crucible at precisely controlled temperatures.

Seed Introduction

A single-crystal seed is dipped into the melt to initiate crystal growth with a defined orientation.

Pulling & Rotation

The seed is slowly pulled upwards while rotating to ensure uniform growth and composition.

Solidification

The molten silicon solidifies onto the seed, forming a large, defect-free single crystal ingot.

Inert Atmosphere

The entire process is conducted in an inert atmosphere (e.g., argon) to prevent contamination and ensure maximum purity.

Purity

Semiconductor-grade wafers are typically 9N (99.9999999%) pure or higher, as even trace impurities can interfere with electrical properties.

Production Method

Wafers are meticulously processed from ingots in a multi-step process:

Top & Tail Cutting

The ends of the silicon ingot are removed to eliminate impurities and crystallographic defects that accumulate during the growth process.

Squaring

The cylindrical ingot is shaped into a square or rectangular cross-section to optimize the material for efficient wafer slicing.

Silicon Block Formation

The squared ingot is cut into smaller, more manageable blocks, which serve as uniform precursors for the wafering process.

Cropping

The silicon blocks are precisely cropped into smaller, uniform pieces to ensure consistency in size and shape before slicing.

Outer Diameter (OD) Grinding

The wafers undergo grinding to achieve the exact required thickness and a high-quality, smooth surface finish.

Wafering

The blocks are sliced into thin wafers using precision diamond wire saws, a critical step that defines wafer thickness and flatness.

Chamfering

The wafer edges are beveled to prevent chipping and enhance mechanical strength during handling and subsequent fabrication steps.

Core Electronics & Energy

Silicon's dominance in photovoltaics and power electronics, where it's the established workhorse.

Advanced Specialized Silicon

Niche but critical high-value markets like aerospace, defense, MEMS sensors, and silicon photonics.

The Next Frontier

Emerging technologies where silicon is poised to be the key enabler, from batteries to quantum computing.

eSand: The Asset-Referenced Token to Digitalize Thesaur Quartz Sand Industries

eSand is the world's first regulatory-compliant phygital asset, merging high-value physical resources with the power of digital finance. Each token, anchored to one metric ton of validated high-grade silica sand, is the bridge between real-world commodities and the future of finance.

1. Project Financing

Token sales income from early adopters and institutional investors provides financing for the Real-World Asset (RWA).

2. Yearly Net Profits

The RWA generates yearly net profits through the extraction and processing of high-value minerals.

3. Rewards & Value Raise

Profits from industrial value-creation are distributed to Thesaur shareholders via dividends, and to eSand tokenholders via rewards, creating and driving digital value appreciation for the eSand ART.

Direct Asset Backing

Each token is directly backed by one metric ton of physical high-grade silica sand, a vital raw material for solar, semiconductor, and advanced materials industries.

High Upside Potential

Raw sand at $30/ton transforms into HPQS and other derivatives valued at $800-$1,000/ton, creating immense value-ascension for token holders.

Value-Ascension Pathway

The token's value is projected to grow with project milestones: $30 (Raw) -> $75 (Processed) -> $200 (Heavy Minerals) -> $400 (Ingot Plant) -> $800 (Full Production).

Transparent & Verifiable

Profit flows are tracked on-chain, ensuring fairness and auditability. Every token is anchored to physical resources, providing asset-backed stability.

Democratized Access & Liquidity

Investors worldwide gain access to a market traditionally reserved for large corporations. Post-MiCA authorization, listing on major exchanges will ensure global liquidity.

Passive Income & Rewards

Holders are not speculators but profit-earning stakeholders, receiving pro-rata rewards based on actual profits from industrial performance.

Exclusive opportunities for early investors, partners, and token holders, available within the 30% equity pool.

1% Equity stake

100k eSand tokens

(Max. 30 packages)

5% Equity stake

500k eSand tokens

(Max. 6 packages)

30% Equity stake

3M eSand tokens

(1 package available)

Packages can be combined. For example, an €8M investment can be structured as one €5M and three €1M packages, with payment terms of the larger package applying.

Acquire eSand TokensA Clear Path to Profitability

Our financial model, based on a definitive feasibility study, projects extraordinary returns driven by high-growth demand and unmatched operational efficiency. The numbers below showcase a venture with robust margins and a rapid payback period.

| Metric | Value |

|---|---|

| Project Life-Cycle | 33+ years |

| Projected Total Revenue | €18.56 Billion |

| Projected Net Profit | €13.85 Billion |

| NPV @ 20% disc. rate | €1.26 Billion |

| Internal Rate of Return (IRR) | 570% |

Exceptional Profit Margins

Forecasts margins exceeding 70% in most operational years, far above industry standards.

Rapid Payback Period

Initial capital is projected to be fully recovered in under two years, with full repayment after the first production year.

| Phase | Amount |

|---|---|

Phase I: Quarry & Processing Initial extraction and processing for HPQS and by-products. | €20M |

Phase II: Ingots & Wafers Financed from Phase 1 cash flow to build high-tech production. | €25M |

| Product Category | 2025 | 2026 | 2027 |

|---|---|---|---|

Construction Sand (( <90% SiO2, 30t bulk) "Cuci" sand deposit | €0.00M | €1.53M | €1.61M |

Construction Sand (( <90% SiO2, 1t big bag) "Neaua" sand deposit | €0.00M | €0.49M | €0.86M |

Construction Sand (( <90% SiO2, 30t bulk) "Neaua" sand deposit | €0.00M | €1.10M | €3.00M |

High Purity Quartz Sand (( >99.50% SiO2, 30t -80t bulk) "Neaua" sand deposit | €0.00M | €3.45M | €6.01M |

High Purity Quartz Sand >99.50% SiO2, (25kg sack) "Neaua" sand deposit | €0.00M | €3.98M | €6.94M |

High Purity Quartz Sand (( >99.50% SiO2, 1t big bag) "Neaua" sand deposit | €0.00M | €7.95M | €13.87M |

Ultra High Purity Quartz Sand >99.9 SiO2, (25kg sack) "Neaua" sand deposit | €0.00M | €7.00M | €12.21M |

Highgrade pottery/fire clay (25kg sack) "Neaua" clay deposit | €0.00M | €1.23M | €2.15M |

Zircon ZrSiO4 (25kg sack) "Neaua" sand deposit | €0.00M | €3.70M | €6.45M |

Titanium Dioxide TiO2 (25kg sack) "Neaua" sand deposit | €0.00M | €12.33M | €21.51M |

Calcium Carbonate (25kg sack) "Neaua" sand deposit | €0.00M | €1.85M | €3.23M |

Silicium Ingots (( 9N = 99.9999999% purity) "Neaua" sand deposit | €0.00M | €97.63M | €170.34M |

Years: 2025 - 2026 - 2027

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2028 - 2029 - 2030

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2031 - 2032 - 2033

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2034 - 2035 - 2036

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2037 - 2038 - 2039

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2040 - 2041 - 2042

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2043 - 2044 - 2045

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2046 - 2047 - 2048

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2049 - 2050 - 2051

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2052 - 2053 - 2054

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Years: 2055 - 2056 - 2057

Construction Sand

(( <90% SiO2, 30t bulk)

"Cuci" sand deposit

Construction Sand

(( <90% SiO2, 1t big bag)

"Neaua" sand deposit

Construction Sand

(( <90% SiO2, 30t bulk)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 30t -80t bulk)

"Neaua" sand deposit

High Purity Quartz Sand >99.50% SiO2,

(25kg sack)

"Neaua" sand deposit

High Purity Quartz Sand

(( >99.50% SiO2, 1t big bag)

"Neaua" sand deposit

Ultra High Purity Quartz Sand >99.9 SiO2,

(25kg sack)

"Neaua" sand deposit

Highgrade pottery/fire clay

(25kg sack)

"Neaua" clay deposit

Zircon ZrSiO4

(25kg sack)

"Neaua" sand deposit

Titanium Dioxide TiO2

(25kg sack)

"Neaua" sand deposit

Calcium Carbonate

(25kg sack)

"Neaua" sand deposit

Silicium Ingots

(( 9N = 99.9999999% purity)

"Neaua" sand deposit

Performance Benchmarking

Compare Thesaur's financial projections against adjustable industry benchmarks to understand our competitive financial advantage.

69,261%

Over the 33-year project life.

570%

Internal Rate of Return.

< 2 Years

Initial capital recovery.

€3.37B

Net Present Value.

Based on German 30y Bonds & inflation differentials.

Based on German AAA premium + RO risk premium.

Unleveraged beta for the mining industry (Source: Damodaran).

Calculated Discount Rate

8.90%

Resulting Project NPV

€3,376.46M

Sensitivity analysis determines how different values of an independent variable affect a particular dependent variable under a given set of assumptions. It is a way to predict the outcome of a decision given a certain range of variables.

By creating a given set of variables, an analyst can determine how changes in one variable affect the outcome. Our analysis models different DCF, NPV, IRR, and ROI results in various hypothetical production output scenarios, reducing uncertainty even in very profitable or challenging market conditions.

A Monte Carlo simulation is used to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables. It is a technique used to understand the impact of risk and uncertainty.

Our financial model was analyzed by modeling a number of parameters and their assumed distributions, resulting in over 100,000 iterations to test the project's resilience against variables like inflation, costs, and exchange rates, ensuring a robust forecast.

Our Strategic Differentiators

We are positioned for market leadership through a combination of superior natural resources, technological innovation, and operational excellence. Interact with the chart to see our edge.

Unique Sedimentary Deposit

Impurities are crust-covering, not ingrained, significantly simplifying purification and lowering operational costs compared to competitors.

Strategic EU-Domestic Source

Located in Romania, we mitigate critical supply chain risks for European high-tech manufacturers, ensuring geopolitical and regulatory stability.

Full Vertical Integration

From raw sand to high-purity Silicium Ingots & Wafers, controlling the entire value chain to maximize margins and quality.

Proven Expert Team

Managed by a team with over 230 years of combined experience in geology, finance, and semiconductor technology.

Valuable By-Products

Utilizing by-products like Titanium and Zircon in a trade-in strategy to acquire polysilicon feedstock at a fraction of market price.

Dual-Revenue Model

A unique investment structure that captures value from both high-margin mineral sales and asset-backed digital token appreciation.

Phygital Ecosystem Roadmap

Guiding tokenholders through every stage of physical industrial growth and digital value creation, from initial permitting to full-scale wafer production. Click on any event to expand.

Begin site surveys, Environmental Impact Studies (EIS), and launch the eSand Project with equipment procurements.

Establish site infrastructure and seek MICA Authorization for the Whitepaper. Value ascension mirrored by eSand begins.

eSand Value Mirror

$30

eSand Value Mirror

$30

Finalize processing plant installation, preparing for operational launch and exchange listings.

Start technological testing, optimization, and staff hiring. Production of HPQS and Construction Sand begins.

eSand Value Mirror

$75

eSand Value Mirror

$75

Commence full-scale production of heavy mineral by-products. First rewards disbursement to tokenholders.

eSand Value Mirror

$200

eSand Value Mirror

$200

Procurement for the Silicon Ingot Plant begins, marking the start of Phase 2 value-add.

eSand Value Mirror

$400

eSand Value Mirror

$400

Full-scale production commences, including HPQS and construction sand.

eSand Value Mirror

$800

eSand Value Mirror

$800

Ecosystem Transparency Hub

Track our progress in real-time. This hub provides a detailed, transparent view of our project's development across key areas, from legal compliance to technology implementation.

The Minds Behind the Mine

Our success is driven by a multidisciplinary team of industry veterans with over 230 years of combined experience in mining operations, mineral processing, sales, logistics, and comprehensive project management.

A performance-driven Company Owner boasting over 24 years of extensive domestic and international administrative experience across start-up and growth-oriented enterprises.

An extensively seasoned Chief Executive Officer with a vast background in the aggregates extraction industry. Proven track record in establishing operational components of the business and searching for new markets.

An advanced Chief Science Officer with a PhD in semiconductors and an impressive 47 years of experience in the field. He holds numerous patents and has developed a unique methodology for industrial-scale silicon purification technology.

Brand architect with over 15 years of experience and a portfolio of international awards and publications. His work focuses on creating brand identities, shaping brand strategy, and leading creative teams.

Emily is an Engineering Geologist and Mining Engineer with extensive expertise in geological and hydrogeological site investigations, 3D modeling of deposits, and geotechnical and hydrological risk and impact assessments.

With over 10 years of experience in sales, business development, and project coordination, Crisan specializes in helping companies grow by acquiring the right clients, building long-term relationships, and delivering measurable results.

An accomplished Chief Marketing Officer with over 20 years of experience in the creative and media industries. She brings a unique blend of creative and strategic skills.

Having steered a diverse portfolio of licensing approvals, processing, and navigating regulatory landscapes and ensuring compliance excellence, she is a proficient Licensing Officer.

A tech innovator with 16+ years of experience in a rchitecting solutions that integrate web development, blockchain, and AI. He specializes in transforming complex ideas into high-impact results that drive business growth.

An accomplished Chief Operating Officer, boasting 30 years of extensive and diverse background. He demonstrates profound expertise in enhancing growth within the industry. Proficient in identifying the connections between production, he lends his expertise to guiding our production towards new heights.

Among the first to earn a Blockchain-focused LL.M. He fosters trust in the crypto industry and is well-positioned to help crypto businesses navigate the EU regulatory framework.

A highly accomplished Chief Legal Officer with an impressive 24-year tenure in the field, with a wealth of experience and expertise in law.

A highly experienced Chief Financial Officer with an impressive 38-year tenure. He is a specialized expert in financial accounting and tax law, with a deep understanding of corporate management, financial planning, risk management, and regulatory compliance.

Experienced professional with over 25 years in the energy and industrial sector. Expertise in project management, financial analysis, and investment strategies in conventional and renewable energy projects.

An accomplished Environmental Officer with 20 years of invaluable experience in environmental stewardship and sustainability. He has a proven track record of managing environmental compliance and conservation initiatives.

Brings over 25 years of experience in the IT and media industry, with a strong background in leading teams and developing digital products.

Proven business leader with a strong track record of driving growth, improving operations, and maximizing profitability. Expert in strategy, operations, and management with a focus on technology.

Distinguished risk mitigation ace with over 20 years of experience in evaluating, devising and mitigating risks across industries including construction, IT, and transportation.

A highly accomplished Chief Sales Officer with an extensive 30-year tenure in sales, including a remarkable decade-long experience as a Sales Director for a market-leading company.

An accomplished Managing Director with over 32 years of experience leading organizations through challenging business cycles and delivering sustainable growth.

Mille-qualified professional and High-Grade psychoanalyst with over 24 years of combined experience in high-performance sports and over a decade in human analysis for business and intelligence purposes.

Press & Insights

Official announcements, in-depth analysis, and updates from the Thesaur project team.

July 29, 2024

Unlocking Romania's Rare Earth Minerals

A detailed look at our core geological asset. Explore the 31.2 million ton Neaua deposit, its unique purity advantages, and the international certifications that verify its value.

August 5, 2024

A Conversation with Zoltan Losonczi

We sat down with Zoltan Losonczi, MBA, the Chairman of the Board at Thesaur, to discuss his vision for the project and the strategic trajectory of the European mineral market.

August 12, 2024

Thesaur’s Phase 1 Mineral Operations

An overview of the €20M Phase 1, detailing the advanced processing technology and diversified product portfolio that forms the strategic backbone for our high-tech ambitions.

Preparing the StGeorge processing platform for the HPQS processing plant. Phase 1 - the demolition of around 15.700sqm reinforced concrete warehouses.

Due Diligence & Transparency

Access our centralized repository of key project documents, including geological surveys, financial audits, and legal opinions.

| Title | Action |

|---|---|

| Executive Summary | Download |

| Legal & Advisory (Disclaimer & Experts) | Download |

| Sand Market Overview & Context | Download |

| Regional Market Analysis (Transylvanian Deposits) | Download |

| Thesaur Asset Portfolio: Cuci & Neaua Deposits | Download |

| Processing Site & Logistics Platform | Download |

| Geological Assessment & Lab Reports | Download |

| Technical & Geological Validation (DFS Summary) | Download |

| Financial Model & Methodology | Download |

| Project Economics & Profitability Analysis | Download |

| Processing Technology & High-Tech Operations | Download |

| Product Specifications (Mineral & High-Tech) | Download |

| Management, Governance & Organizational Structure | Download |

| Environmental & Permitting Framework | Download |

| Complete Investor Deck & Whitepaper | Download |

Read the Full Thesis

Our comprehensive whitepaper provides an in-depth analysis of the market, our operational strategy, financial model, tokenomics, and risk management framework. Download it to gain a complete understanding of the Thesaur Quartz Sand Industries investment opportunity.

Download Whitepaper (PDF)

Our Strategic Deposits

Our assets include a world-class primary reserve at Neaua, a high-value satellite deposit at Cuci, and a dedicated, "brownfield" industrial processing hub. This combination ensures a secure 30+ year resource, streamlined logistics, and readiness for development.

- Location & Logistics: Mureş County, Romania. Strategically positioned 10 km from the planned Târgu Mureş-Iaşi highway and 25 km from the North Transylvanian Highway.

- Validated Resource: Total deposit of 50 million metric tons, with a confirmed 31.2 million tons in the 21-hectare explored area.

- Mine Life: An estimated ~31-year lifecycle based on the planned extraction rate of 1 million tons per annum.

- Resource Quality: Validated raw silica content exceeding 85% (up to 90%), which is processed to +99% purity. The deposit also holds a significant 5.5 million-ton by-product resource of valuable plastic clay.

- Third-Party Validation: Resource estimates and 3D void models were independently reviewed and confirmed by specialist consultancy firms SMinPro (Austria) and RockOptions (United Kingdom) in 2023.

- Logistical Advantage: A 2.7-hectare industrial platform located only 6 km from the Neaua quarry, dramatically minimizing internal transport costs.

- Site Infrastructure: This is a redeveloped "brownfield" site, already equipped with a comprehensive industrial electrical grid, water, and gas services. This status significantly reduces capital expenditure and accelerates the timeline for plant construction.

- Phased Development: The site is cleared and prepared, with 2.1 hectares allocated for the Phase 1 sand processing plant and 0.6 hectares for the Phase 2 silicon ingot & wafer facility.

- Location & Logistics: Geo-location 46.443479, 24.178826, featuring direct access to the Targu Mures - Cluj Napoca highway for easy distribution.

- Resource: Contains approximately 800,000 metric tons of high-grade sand.

- Market Value: The material is an excellent raw material for high-value construction products, including dry plaster and tile adhesives for major European suppliers.

Interactive map showing the locations of Neaua, Sângeorgiu de Pădure, and Cuci deposits.

Become a Part of the Future

The Thesaur investment offers a scarcity play in a strategic European asset, combining technology leadership, proven management, and unique dual revenue streams. We invite sophisticated investors seeking exceptional stability and high growth potential to schedule a direct management presentation or conduct a site visit.

Commitment to Sustainability and Community

Our operational ethos is founded on responsible stewardship and community integration, blending environmental science, geotechnical analysis, and regulatory compliance to harmonize industry with societal well-being.

We have a resolute commitment to fostering strong, symbiotic relationships with local communities, integrating societal engagement into our operational ethos.

Rigorous environmental impact assessments scrutinize repercussions on ecosystems, hydrology, and air quality to ensure our footprint minimizes ecological disruption.

By integrating local knowledge and preferences into the planning process, we cultivate a quarry that harmonizes industry imperatives with societal and environmental well-being.

Our 2.7-hectare processing site is situated on a former industrial cooperative, representing a significant redevelopment and modernization of a legacy industrial zone.

90%

Water Recycling

Our AquaCycle thickener recovers over 90% of process water for re-circulation.

67

New Positions Created

39 operational and 28 administrative roles will be created for the local workforce.

€45M

Capital Investment

A significant investment in developing the region's high-tech industrial capacity.